WE FOCUS ON OPTIMIZING THE VALUE OF YOUR LAND & TIMBER

LTM provides an organized, planned approach to the management of your land and timber assets. We combine accurate data acquisition and analysis and apply it to local market and regional trend information to provide a clear picture of the potential of your investment from a purely financial perspective. We then fine-tune the plan to match your specific expectations for sustainability, revenue needs and long-term goals.

LTM's analysis and planning work provides the landowner with a clear picture of the potential profitability of a timberland investment and a guidepost from which to make future decisions.

LTM's analysis and planning work provides the landowner with a clear picture of the potential profitability of a timberland investment and a guidepost from which to make future decisions.

attributes of a timber investment

|

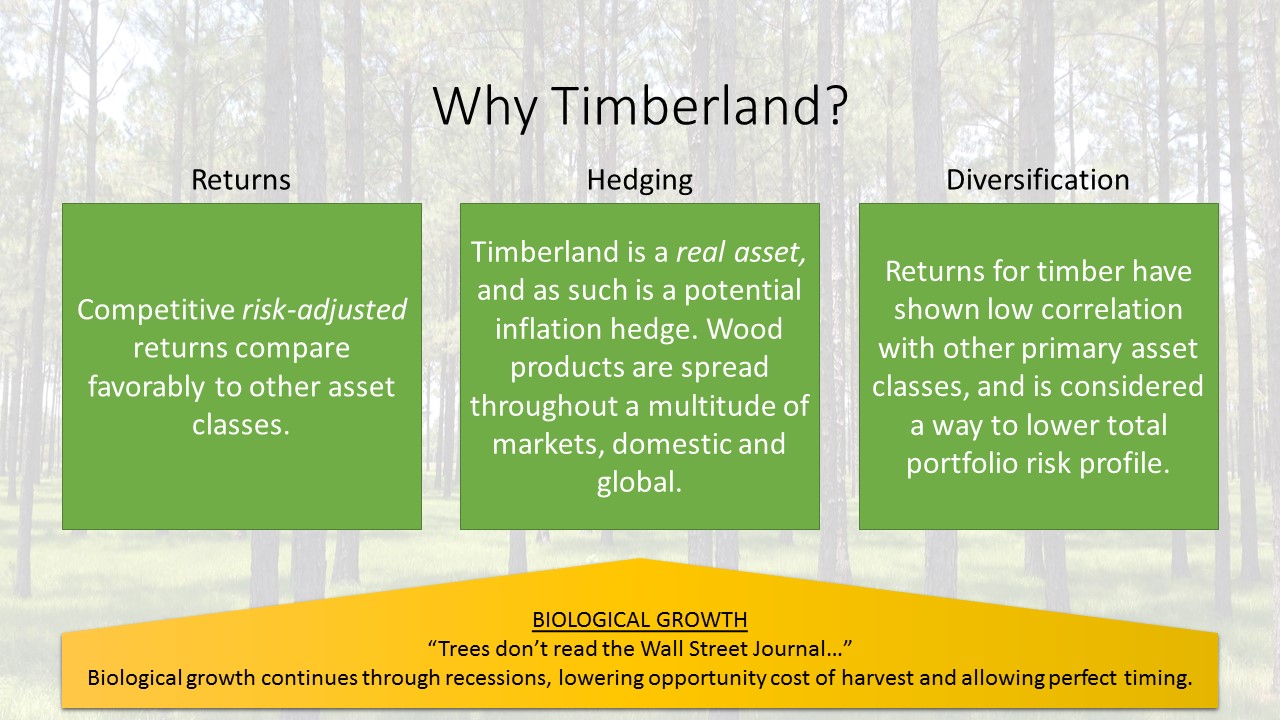

Timberland offers good returns, low volatility, portfolio diversification and protection from inflation. Timber as a commodity is steadily increasing in value as global demand grows. Historically, it has provided competitive, risk-adjusted returns compared to other major asset classes. Timberland investments have features that bring a unique diversity to any investment portfolio. Timber is generally believed to be an inflation hedge since it is a real asset that behaves like other agricultural and natural resource commodities. It also tends to have a low return correlation to other asset classes, meaning it has the potential to reduce a portfolio's risk profile through greater diversification.

|

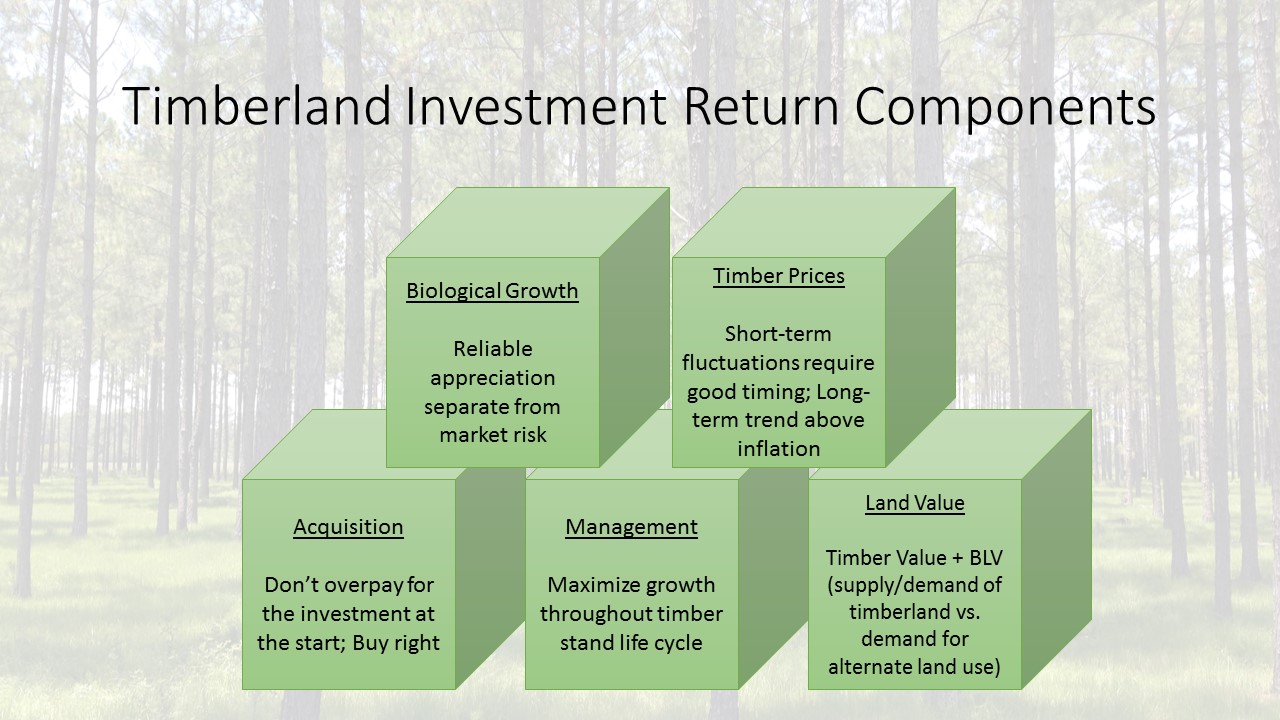

Lastly, and perhaps most uniquely, timber has a biological growth component that is completely separate from what the market is doing. Trees keep growing in volume despite market downturns, so the opportunity cost for not cutting is reduced and the investor has the freedom to adjust to the market before selling. |

the fundamentals of timberland investing are the same for everyone

Whether you' re a Real Estate Investment Trust (REIT), such as Plum Creek or Rayonier, a pension fund such as TIAA or CALPERS or a forward-looking, sophisticated individual investor, the fundamentals of successful timberland investments are the same. Acquire property with high productivity, in an active timber market, at an advantageous price and aggressively manage it to optimize your timber returns and land appreciation. When you optimize your timber management you positively affect both the timber and land sides of your investment. As your timber grows in value, your land appreciates at an increasing rate.

To accomplish this REITs and Pension Funds have large staffs dedicated to the various aspects of their type of timberland investment management. Individual or group investors are best served by engaging a professional, experienced, knowledgeable and accountable timber management firm that is dedicated to the success of its clients.

To accomplish this REITs and Pension Funds have large staffs dedicated to the various aspects of their type of timberland investment management. Individual or group investors are best served by engaging a professional, experienced, knowledgeable and accountable timber management firm that is dedicated to the success of its clients.

Land & TImber Management, Inc. is that kind of firm

LTM understands timber and timberland. We are experts in:

To discuss the particulars of our professional management, please call us at 850-668-8333 or visit our Contact Page.

- analyzing individual timber tract options (timber valuations, growth and yield modeling, sample cash flows, etc.)

- modeling and reporting on all phases of the timberland investment life cycle, from reforestation to final harvest and acquisition to sale

- breaking every step down to the potential returns it offers

- seeking out opportunities for alternative revenue generation (hunting, pine straw, etc.)

- providing the quality field services and oversight required to realize your goals

To discuss the particulars of our professional management, please call us at 850-668-8333 or visit our Contact Page.